We’ve partnered with ROK Financial to be able to offer you business financing fast!

Any type of lending you need from bridge loans, SBA, Equipment financing, Working Capital and more!

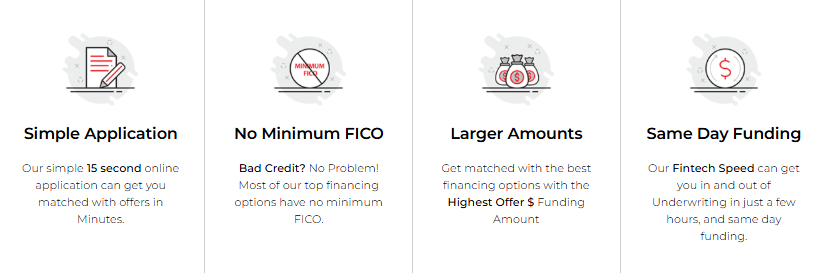

What you need to qualify is 3+ months in business, $5k/monthly gross sales but there’s no minimum FICO to applying!

Business Financing FAQs

1. Who is ROK Financial?

ROK Financial is a business lending platform that connects small and mid-sized businesses with a wide range of funding options, including working capital, equipment financing, SBA loans, and more. They act as a marketplace lender, allowing businesses to compare multiple offers through one streamlined process.

2. What types of financing does ROK Financial offer?

ROK provides access to several funding products, including:

Construction loans (Commercial Real Estate, Residential Investment Property Funding, and Fix and Flip Financing options)

Working Capital Loans

Equipment Financing

Business Lines of Credit

Term Loans

SBA Loans

Invoice Factoring

Merchant Cash Advances

Start-Up Funding Options (depending on credit and revenue)

3. What are the basic requirements to qualify for funding?

While each lender has its own criteria, general guidelines include:

Minimum 6 months in business

$10,000+ in monthly revenue

A business bank account

Fair to strong credit (depending on the product)

SBA and long-term financing may require stronger credit and longer time in business.

4. How fast can my business get funding?

Many working capital or short-term financing options can fund within 24–48 hours after application and document submission.

More complex loans (equipment, SBA, term loans) take longer due to underwriting.

5. Will applying through ROK Financial affect my credit score?

Initial qualification typically uses a soft credit pull, which does not impact your score.

A hard pull may occur later in the process only if you decide to move forward with a specific lender.

6. Why use ROK Financial instead of going directly to a bank?

ROK’s marketplace model allows businesses to:

Compare offers from multiple lenders

Access approvals even if traditional banks say no

Receive faster decisions and funding

Match with a loan product tailored to their cash flow and credit profile

It’s designed to save time and improve approval odds.

7. Can start-ups get funded through ROK?

Yes—while options are more limited, start-ups may qualify for:

Equipment financing (if equipment secures the loan)

Certain revolving credit options

Personal credit–based funding or unsecured loans (depending on credit strength)

8. Is there a fee to apply?

No. There is no cost to apply.

ROK is compensated by its lending partners only when funding is approved and accepted, so there’s no upfront cost for your business.

9. What documents do I need to apply?

Requirements vary by product, but commonly requested documents include:

Last 3–6 months of business bank statements

Driver’s license

Voided check

Business tax returns (for larger loans or SBA)

Financial statements (profit/loss, balance sheet for larger requests)

10. How does the partnership through our marketplace work?

Your business can apply directly through our integrated ROK Financial portal.

ROK’s team will guide you through the funding process, while our platform ensures your experience remains seamless and supported.