Lending Help

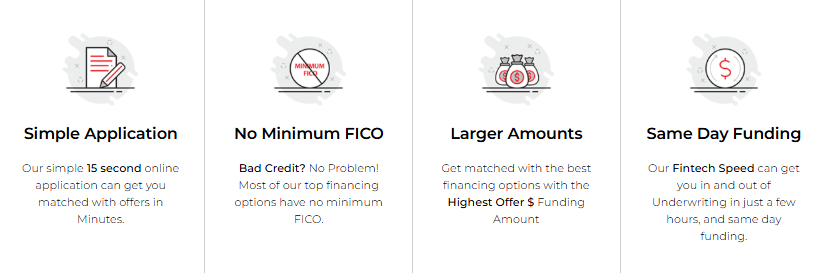

We’ve partnered with ROK Financial to be able to offer you business financing fast!

Any type of lending you need from bridge loans, SBA, Equipment financing, Working Capital and more!

What you need to qualify is 3+ months in business, $5k/monthly gross sales but there’s no minimum FICO to applying!

Business Resources

Our partners at Vizible use AI to help you grow and scale your business by marketing. They can help you find clients, manage pipelines, and create more deals.

Click here to route to a specialist.

Our partners at ThinkUp have created an AI tool to help you on your founder journey. Like Chat GPT but for business planning.

Whether it’s a side project, a future startup, or a concept worth exploring, ThinkUp gives a structured, guided journey to understand if it’s actually worth pursuing.

Click here to learn more.

We have a variety of venture studios who look for high growth companies in various industries to invest their money in. On top of that, they also can help you with fractional executive work like marketing help, accounting/finance, sales; they can help you set up your back office and plan your business.

Click here to learn more.

Business Resources FAQs

1. What types of business resources does Ironvest offer?

IronVest offers a comprehensive set of resources that support both day-to-day operations and long-term growth, including:

Capital & Funding Access

Working capital and growth financing

Equipment financing

Lines of credit and term loans

SBA and structured financing

Commercial and investment real estate funding

Start-up and early-stage capital options

Strategic introductions to venture capital and growth investors

AI & Technology Tools

ThinkUp – an AI business assistant built specifically for business owners to help with strategy, planning, operations, and decision-making

Business intelligence and automation tools through IronVest’s technology partners

Marketing & Growth Support

Vizible – AI-powered marketing and visibility tools that help businesses refine messaging, improve online presence, and drive customer acquisition

Brand positioning, growth strategy, and go-to-market support through venture studio partners

Venture Studio & Strategic Partnerships

Access to IronVest’s venture studio partners offering expertise in product development, marketing, operations, and scaling

Warm introductions to strategic partners, investors, and advisors aligned with your business stage

2. How does Ironvest help businesses beyond financing?

IronVest is built around the idea that capital alone doesn’t create growth.

In addition to funding access, businesses receive:

AI-driven insights to support smarter decisions

Marketing tools and strategic guidance to improve visibility and revenue

Access to experienced operators and venture partners who have helped scale businesses

This integrated approach helps founders use capital more effectively while building sustainable growth.

3. What are the basic requirements to access capital through Ironvest?

Requirements vary by funding option, but general guidelines include:

At least 6 months in business

$10,000+ in monthly revenue (some early-stage options available)

A business bank account

Fair to strong credit, depending on the product

Early-stage companies may still qualify for non-dilutive funding, tools, and strategic support.

5. How fast can businesses access funding?

Certain working capital or short-term options can be funded within 24–48 hours after approval.

More structured financing—such as SBA, equipment, or real estate—requires additional underwriting and time.

6. Will applying impact my credit score?

Initial qualification typically uses a soft credit check, which does not affect your credit score.

A hard credit pull only occurs if you choose to proceed with a specific funding option.

7. Are Ironvest’s resources available to start-ups?

Yes. IronVest supports businesses at multiple stages, including start-ups and early-stage founders.

While funding options may be more limited early on, start-ups can still access:

AI tools like ThinkUp

Marketing support through Vizible

Strategic guidance from venture studio partners

Select early-stage funding or investor introductions, when appropriate

8. Is there a cost to use Ironvest?

There is no upfront cost to explore IronVest’s platform or apply for capital.

Some services and tools may have usage-based or partner-related fees, which are always disclosed upfront.

9. What information is needed to get started?

Depending on the resources you’re accessing, you may be asked for:

Basic business information

Recent bank statements (for funding requests)

Identification and business documentation

Financial statements for larger or long-term capital needs

IronVest’s team helps guide you through each step.

10. How do Ironvest’s venture studio partnerships work?

IronVest collaborates with a network of venture studios, technology providers, and growth partners to support businesses beyond capital.

Based on your goals and stage, IronVest may introduce you to partners who can help with:

Marketing and customer acquisition

Product and technology development

Operations and scaling strategy

Capital formation and investor readiness

These partnerships allow IronVest to act as a long-term growth partner, not just a funding source.